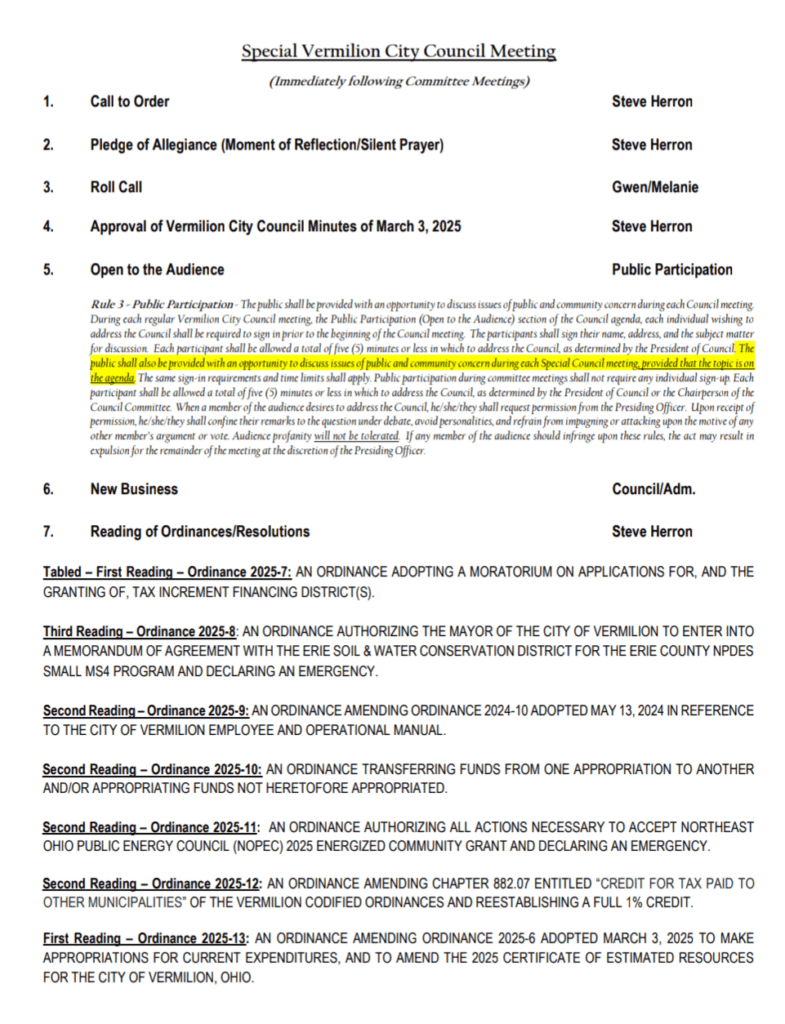

At the Vermilion City Council’s Legislative Committee meeting on March 10, discussions intensified over Ordinance 2025-12, which proposes restoring the full 1% income tax credit for residents who work outside the city. The debate centered on the financial impact of such a move and potential tax relief for seniors.

At Large council member Gary Howell initiated the discussion by highlighting the ordinance’s potential effects on city revenue. “If this were reversed, it would short the road fund by approximately $600,000 annually,” he noted. Finance Director Amy Hendricks estimated the impact at around $500,000 to $600,000 per year. This money is currently dedicated to maintaining and repairing the city’s roads.

Despite concerns over revenue loss, some council members saw an opportunity to balance tax relief with available funds. Ward 2 Councilman Greg Drew suggested that the city could offset the impact by allocating $2 million into the road fund, covering the lost revenue for three to four years. “That would give residents a temporary tax break while we navigate other financial burdens like rising water rates and a potential school levy,” he added.

A proposal to exempt residents 65 and older from paying city income tax on earnings outside Vermilion gained traction. “I’ve been advocating for something to support our seniors,” said Drew. “If we can amend this ordinance to include that exemption, you might twist my arm enough…” Ward 3 Councilman Drew Werley echoed this sentiment but recommended separating the senior exemption into a standalone ordinance.

Introducer of the tax credit restoration, Werley, argued that the reduction should be seen as returning money to residents rather than stripping city services. “In 2016, council took away this half-percent credit after multiple failed attempts to raise income taxes. It was a decision made by seven members years ago, and I think it’s time to give that money back to the people,” he stated. Werley also pointed out that increased property tax revenue has bolstered the city’s financial position, mitigating concerns over lost income tax revenue.

Ward 4 Councilman Jeff Lucas on was more cautious, recalling the city’s past financial struggles. “In 2016, we were in dire financial straits. We needed that money,” Lucas recalled. “But today, we’re in a stronger position. If we’re going to reconsider this, now might be the time.”

Discussion also touched on the specifics of the senior exemption. Finance Director Amy Hendricks suggested broadening the exemption to include all seniors regardless of where they work. “Many seniors take part-time jobs close to home rather than commuting. If we truly want to support them, we should consider exempting all seniors from city income tax,” she argued. Drew expressed agreement but emphasized the need to assess the financial impact before making such a sweeping change.

Council President Steve Herron highlighted the importance of balancing their decisions,”We have an obligation to fix the roads in this city… It’s a little more complicated than just percentage.” Reminding council all decisions made could have both positive and/or negative ououtcomes.

Audience member Homer Taft approached the podium and spoke to council. He took exception to what he called a “…falsehood stated repeatedly that there a half of a percent that goes to the street fund and that it’s in the ordinance. I defy anyone to find it in the ordinance, because I have all the ordinances and it doesn’t say it anywhere.”. He stated that, “Money is put into the roads fund by the budget and resolution of this Council every year.”. Taft addressed the impact of these increases in 2013 and 2016 as cumulative since 2017. “I think it’s covered for a good many years” Taft added, alluding to the revenues collected from 2017 till present day being excessive.

As the discussion concluded, council members debated how best to move forward. Two draft ordinance proposals, including the senior income tax exemption, are expected to be reviewed at the next council meeting. Drew suggested making the ordinance effective upon passage to avoid complications with retroactive reimbursements.

The debate underscores a fundamental challenge: balancing financial responsibility with taxpayer relief. With further discussion and potential amendments ahead, the future of Ordinance 2025-12 remains uncertain, but it is clear that tax policy will remain a key issue for Vermilion’s leadership in the months to come.

1 thought on “New Tax Credit on the Table—Will Vermilion City Council Approve It?”

Comments are closed.