COMMENTARY BY WILL KOHLER

I suppose I have some street cred regarding tariffs. Other than Antarctica, I’ve done big export and manufacturing deals on every continent of the world. Under Bush (#43), Obama, and Trump, I served for many years on a federal export counsel. I sold an American military defense business whose major client was the Sultan of Brunei. I sold Lamborghini to the ruling family of Indonesian.

But I’m baffled by the current tariff strategy.

It’s true that free trade under NAFTA (now called USMCA) destroyed much of American manufacturing and created the rust belt we live in. Previously, unionized Americans made good money, making things like cars and car parts. With free trade, those jobs went to Mexico and Canada over the course of many years, leaving us with industrial blight.

It might seem that reversing free trade by establishing significant tariffs would cause businesses to create American manufacturing jobs. Foreign businesses might move manufacturing here. American businesses might expand operations her.

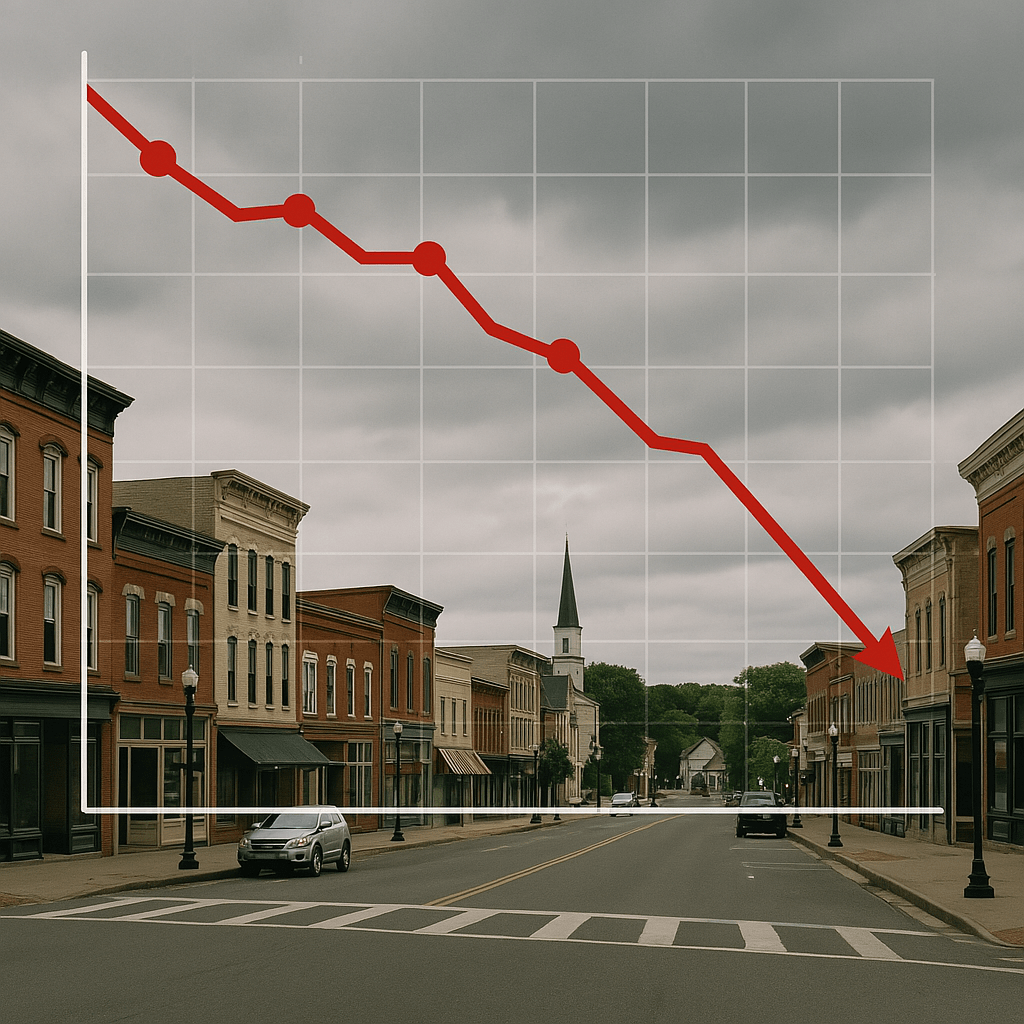

But problems with the current tariff approach have instead threatened American investment. For several reasons, it’s caused many investors to begin considering America a bad place to invest.

Investors see risk in the erratic implementation of tariffs. Tariffs have been generally paused for 90 days, but will they be renewed? If they are not renewed, they won’t serve to protect American investments. If they are renewed, prices for cars, electronics, lumber, and pretty much anything made overseas, will be higher; and the prospect of higher prices is already driving us into a recession. Job creation dries up during a recession.

We’re told that deals are being made with our trading partners. But we haven’t been told that those deals involve investments in American manufacturing. If they do, then that’s not necessarily a good thing. Governments make a mess of things when they get involved in business. Let’s say China agrees to establish a car plant in America. It will only survive if there’s natural market demand, and in the interim American car manufacturers will face unnatural government-induced competition.

In my opinion, action should have been taken less impulsively. The dollar’s decline and collapse of slump in the stock and bond markets over the past 2 weeks proves that point.

Keep in mind, this is an economic viewpoint, not a political statement. I’m interested in your viewpoint, so please leave your comments below. Thanks for reading! –Will Kohler

Will Kohler lives and works in Vermilion, Ohio. He is CEO of VELN Legal, a law firm that represents businesses in their commercial dealings. He served as Chief Legal Officer for major corporations and held leadership positions at prominent law firms. He is also an economist by training. He holds a law degree. from the University of Michigan Law School, an M.B.A. from Michigan State University, an M.S. from Texas A&M, and a B.S. in economics from the University of Michigan. He is a woodworker and sailor, who sails his 65-year-old ketch on Lake Erie.