Talkin' TIFs

A TIF is a debt of the county/city. That’s just like credit card debt – that the people of the county/city have to repay.

A $30M TIF would cost $89M to repay over 30 years. If the development doesn’t happen after the $30M is spent, taxpayers (meaning YOU) on are the hook for $89M.

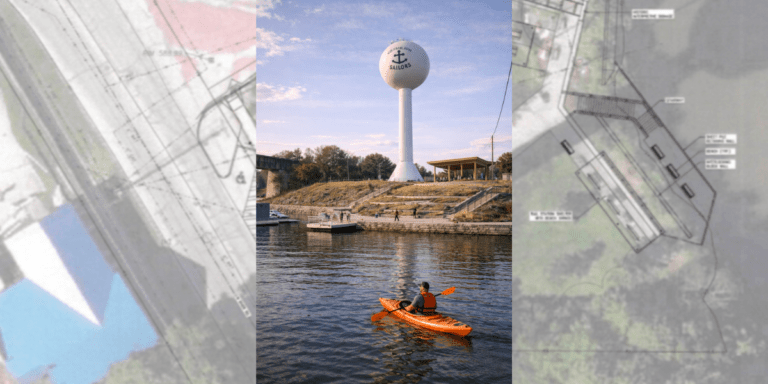

Will the commercial portion really fully happen? 70 acres of businesses will need to be persuaded to locate in a sparsely populated area. Yet the Vermilion Shores complex has attracted just one gas station.

A TIF doesn’t “guarantee” monetary benefits for schools and it is highly dubious that the anyone would say otherwise. There’s no such thing as a guarantee, just like there’s no such thing as a free lunch. The whole thing could be a financial disaster, even if new development comes to fruition, the additional property tax revenues would be used to repay the TIF (the credit card).

A $30M TIF would mean that $89M in property taxes from new development would NOT be shared with schools or the city. And $89M in property taxes MUST be generated to avoid financial problems for taxpayers.