Taxes are a part of life, but understanding where your money goes and how it’s used can be confusing. This article is meant to give a very simple explanation of how income tax and property tax work in Vermilion. While there are many details and exceptions, this will provide a general idea of what each tax is and where the money goes.

Income Tax: What It Is and Where It Goes

What It’s Taxing:

- A percentage of the money you earn from work, investments, or other sources.

Who Pays It:

- Anyone who earns taxable income.

Who Collects It:

- Federal Government – Used for national defense, Social Security, Medicare, and federal programs.

- State of Ohio – Funds education, roads, state parks, and other services.

- City of Vermilion – The city collects a flat 1.5% income tax on earned income to fund local services like police, fire and roads if you work in Vermilion. Vermilion partners with the Regional Income Tax Agency (RITA) to collect and process this tax.

- If you work out of the city the first half of the year is 100% forgiven and you pay .75% on the second half of the year on city income tax.

How It’s Calculated:

- Federal and State Income Tax – Based on how much you earn, with different tax brackets.

- Vermilion’s Income Tax – A flat 1.5% tax on earned income (not investment income).

Where the Money Goes:

- Federal Taxes – National programs (military, Social Security, federal agencies).

- State Taxes – Schools, roads, state agencies, state parks.

- Local Taxes – Vermilion police, fire, road maintenance, parks, and city operations.

Property Tax: Owning a Piece of Vermilion

What It’s Taxing:

- The value of your land and buildings.

Who Pays It:

- Anyone who owns property in Vermilion.

Who Collects It:

- Erie County Auditor – Determines the property’s value and calculates taxes.

- Erie County Treasurer – Collects the property taxes.

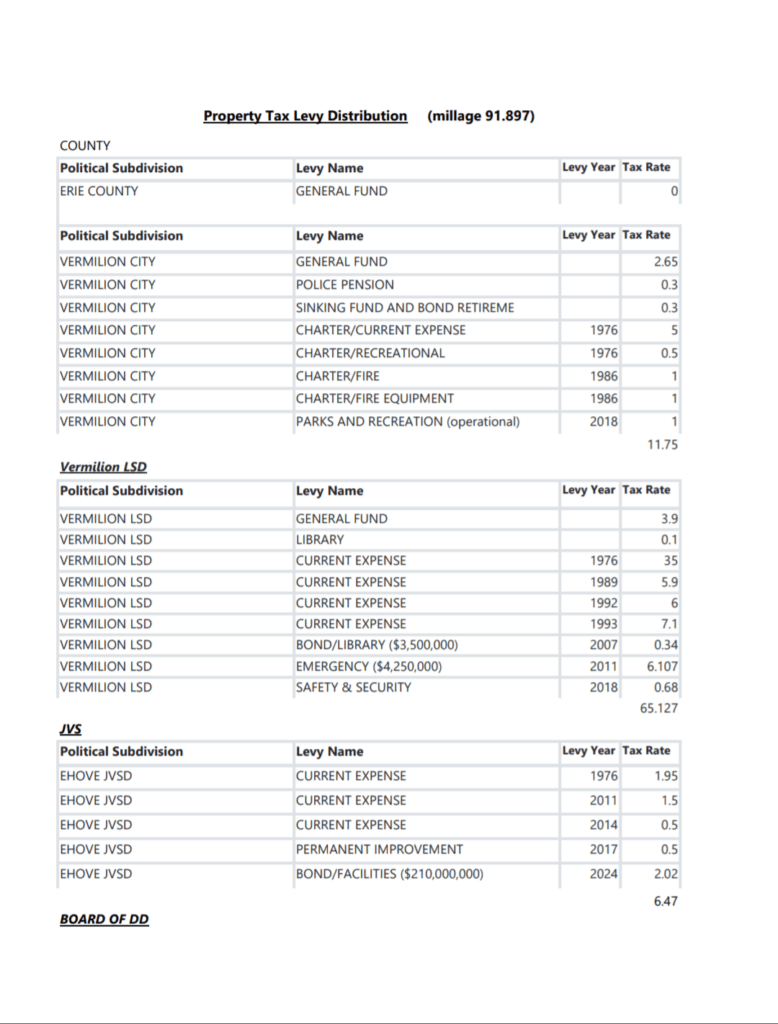

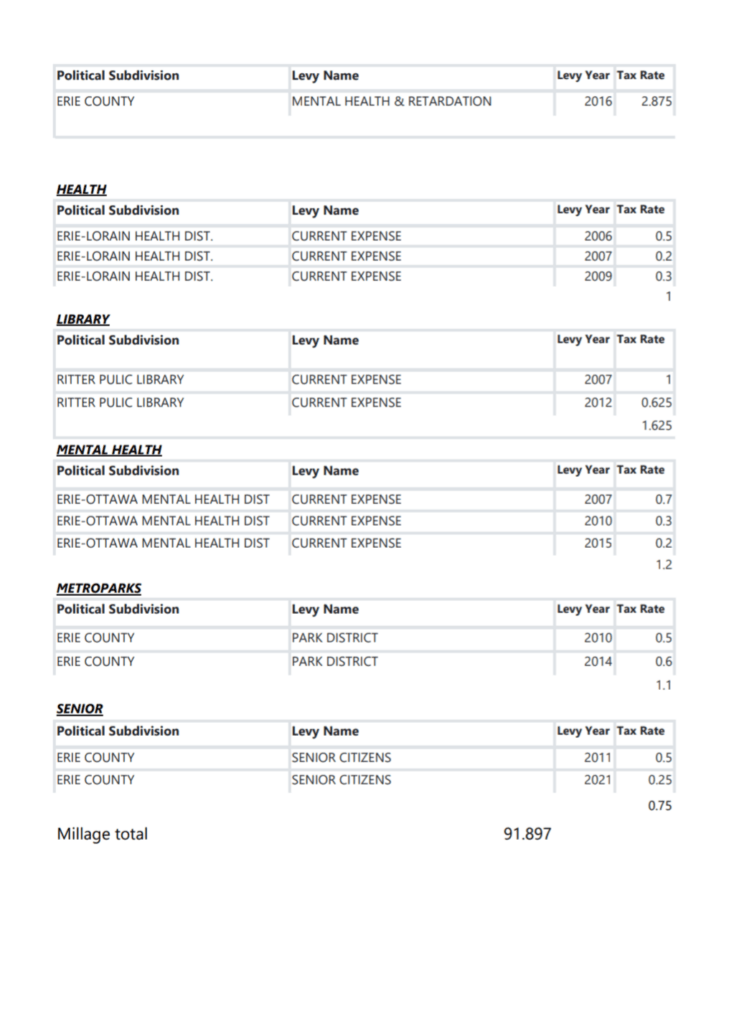

Where Your Property Taxes Go:

- Vermilion Local Schools – Usually the largest portion, paying for teachers, school buildings, and educational programs.

- City of Vermilion – Helps fund police, fire, roads, parks, and city services.

- Erie County – Pays for the county sheriff, courts, and other county services.

- Vermilion Township (if applicable) – Supports township services for those in the township.

- Other Levies – May include funding for the library, Metroparks, or other special projects.

How It’s Calculated:

- Assessed Value – The Erie County Auditor assesses your property’s value (usually lower than market value).

- Tax Rate (Millage) – Each taxing authority (schools, city, county) sets a rate, called millage.

- Example Calculation:

- If your property’s assessed value is $100,000 and the tax rate is 20 mills, you’d calculate:

- ($100,000 ÷ 1,000) × 20 = $2,000 in annual property tax

- If your property’s assessed value is $100,000 and the tax rate is 20 mills, you’d calculate:

Key Differences Between Income Tax and Property Tax

What It’s Taxing:

- Income Tax – Money you earn from work or investments.

- Property Tax – The value of land and buildings you own.

Who Pays It:

- Income Tax – Anyone with taxable income.

- Property Tax – Only property owners.

Who Collects It:

- Income Tax – Federal, state, and local governments.

- Property Tax – Local governments, including schools, city, county, and townships.

How It’s Calculated:

- Income Tax – Based on your earnings, with different tax rates.

- Property Tax – Based on your property’s assessed value and millage rate.

Where the Money Goes:

- Income Tax – Funds federal programs, state services, and local government operations.

- Property Tax – Primarily funds schools, plus city services, police, fire, and local government operations.

Staying Informed

Taxes may not be fun, but knowing where your money goes helps you stay informed about your community.

- Vermilion Income Tax Questions? Contact RITA (Regional Income Tax Agency).

- Property Tax Questions? Contact the Erie County Auditor (for assessments) or the Erie County Treasurer (for payments).

- State Income Tax Questions? Contact the Ohio Department of Revenue.

- Federal Income Tax Questions? Contact the IRS.

Want to have a say in where your tax dollars go? Attend local government meetings, vote on tax levies, and stay engaged with your community!